At Fingluet, we understand that tax management and preparation can be complex and time-consuming. Our comprehensive tax outsourcing services are designed to simplify your tax processes, ensuring compliance, accuracy, and efficiency. By outsourcing your tax functions to us, you can focus on your core business activities while we handle the intricacies of tax management.

Accurate Tax Returns: Preparation and filing of accurate and timely tax returns, ensuring compliance with all relevant tax laws and regulations.

Individual and Corporate Taxes: Expertise in preparing tax returns for both individuals and businesses, including corporations, partnerships, and sole proprietorships.

Multi-State and International Taxation: Handling complex tax requirements for multi-state and international operations, ensuring comprehensive compliance.

Strategic Tax Planning: Develop strategic tax planning solutions to minimize tax liabilities and maximize savings.

Tax Optimization: Identify opportunities for tax deductions, credits, and incentives to optimize your tax position.

Year-Round Advisory: Provide ongoing tax advisory services to help you make informed financial decisions throughout the year.

Regulatory Compliance: Ensure adherence to all local, state, federal, and international tax regulations, reducing the risk of penalties and fines.

Tax Reporting: Prepare and submit all required tax reports and documentation, ensuring accurate and timely compliance.

Sales Tax Compliance: Manage sales tax collection, reporting, and remittance for your business.

Use Tax Management: Ensure accurate use tax calculation and compliance for purchases and other taxable activities.

Payroll Tax Filing: Handle the calculation, reporting, and payment of payroll taxes to ensure compliance with employment tax regulations.

Employee Withholdings: Manage employee tax withholdings and ensure accurate payroll processing.

Audit Preparation: Assist in preparing for tax audits, ensuring all necessary documentation is organized and accurate.

Audit Representation: Provide expert representation and support during tax audits to protect your interests.

Let Fingluet be your trusted partner in tax management and preparation. Our comprehensive outsourcing services are designed to simplify your tax processes, ensure compliance, and provide strategic tax planning to help your business thrive. Contact us today to learn more about how our tax management and preparation services can benefit your business.

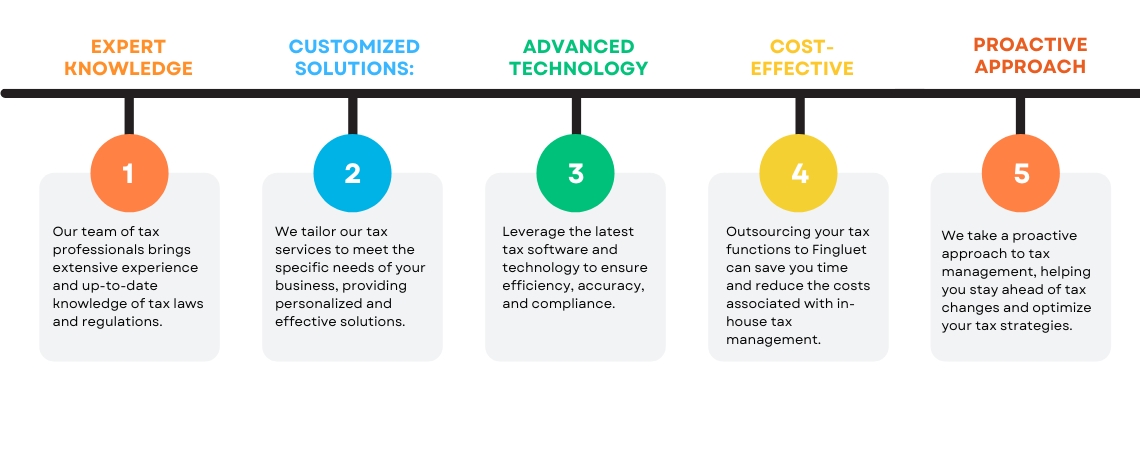

Expert Knowledge: Our team of tax professionals brings extensive experience and up-to-date knowledge of tax laws and regulations.

Customized Solutions: We tailor our tax services to meet the specific needs of your business, providing personalized and effective solutions.

Advanced Technology: Leverage the latest tax software and technology to ensure efficiency, accuracy, and compliance.

Cost-Effective: Outsourcing your tax functions to Fingluet can save you time and reduce the costs associated with in-house tax management.

Proactive Approach: We take a proactive approach to tax management, helping you stay ahead of tax changes and optimize your tax strategies.

Simplify your Business

Management Processes

With Fingluet's Personalized

Services.